Menu

August 30, 2023

It’s been a crazy few years for self storage. There have been a number of big shake-ups in the industry, and it can be hard to keep track of what is going on and what actually matters.

Whether you’re managing a facility, operating one behind the scenes, or investing from the sidelines, it can be a bit hard to keep track of all of that market data. It can be even more difficult to keep it in perspective.

Let’s dive into the current state of the industry to try and bring all of the great data out there together.

When it comes to self storage, the name of the game in 2023 has been normalization.

If you’re new to the storage industry as of 2020 or after, this year has probably presented you with an unfamiliar scenario: rates dropping, rentals slowing, and concern. If you’re not new to self storage, these concerns probably aren’t new to you. Hopefully, you haven’t let your guard down during these past few years of surplus.

Looking at data from sources such as Radius+ and Yardi, it’s clear that we’re no longer seeing rates and demand rise year after year.

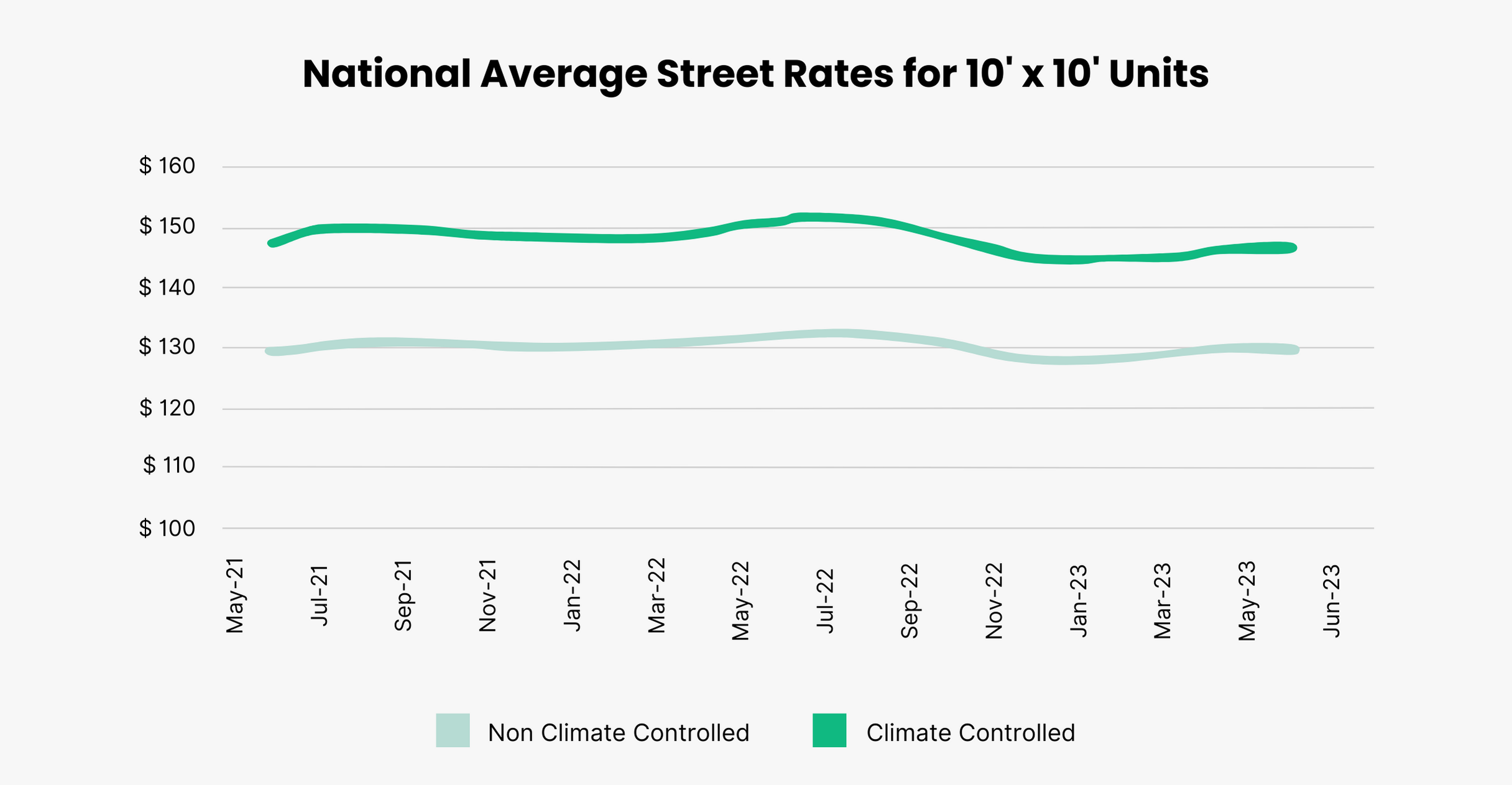

This data drawn from Yardi Matrix paints a pretty clear picture: Rates have fallen Year-Over-Year.

We can see a bump when entering the summer months, indicative of summer’s strong rental season. That’s still true this year, but the rise (and fall) are both lower in 2023 than in the last few years.

This is reporting from the big national players in the top 50 markets, so your experience in your local market may differ.

Here's some quick context:

But not everything is doom and gloom.

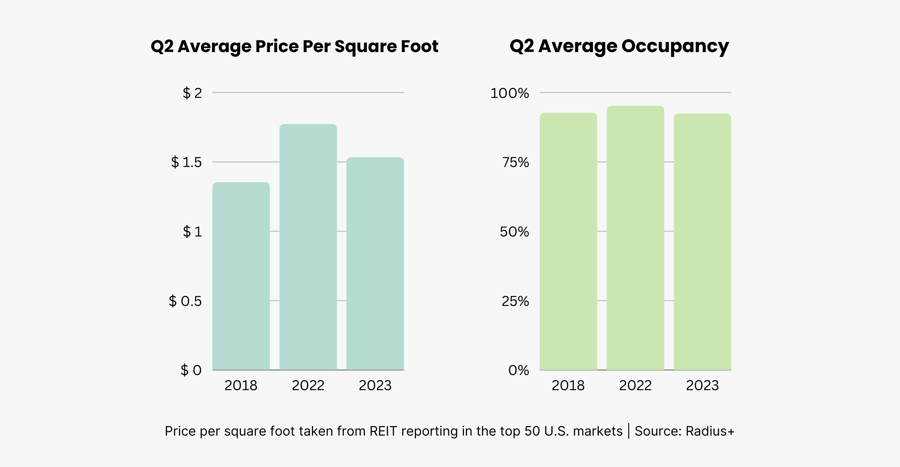

It may seem bad when you only look at this year’s reporting versus 2022, but there is some important context:

These numbers are still up from five years ago.

The global pandemic boosted storage to new heights. While we’re gliding back down from those peaks, we haven’t yet landed at pre-pandemic numbers.

And considering that there are far more storage facilities today than in 2018, being roughly even in average occupancy actually suggests a higher demand.

Because things have been booming, you may be fooled into thinking that a slowdown means you’re doing something wrong.

Maybe your marketing is falling flat, or your managers aren’t selling.

If you’re feeling this pressure, here’s some comforting news: it’s not just you. It’s probably nothing you’re doing wrong, but instead, it’s just market conditions.

Joe Margolis

CEO, Extra Space

In its reporting call on second-quarter results, Extra Space painted a picture that many operators can relate to: lower rates and fewer rentals.

Extra Space (and other REITs) have largely managed to keep their revenue high by cutting expenses and raising rates on long-term customers, but they reported a drop in street rates compared to the same period last year.

They also reported that same-store occupancy was down more than 1% from last year’s second quarter—94.5% versus 95.8% from Q2 2022.

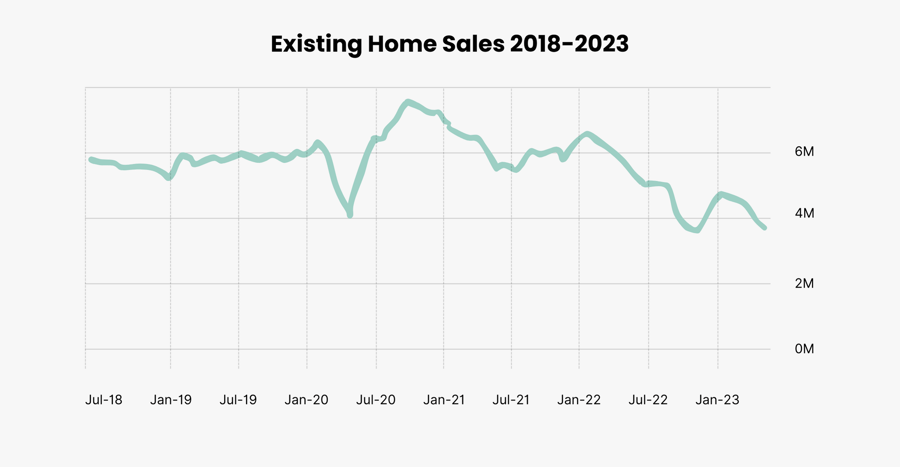

Public Storage reported similar trends. Their CFO, Tom Boyle, also cited a decline in existing home sales leading to less seasonal demand this past summer.

Here’s a look at existing home sales to help visualize what he’s talking about, sourced from the National Association of Realtors:

Meanwhile, Yardi Matrix’s Year-Over-Year rent change report shows that rates in major metro areas were down as much as 9% in some areas (with only Charleston escaping the decline).

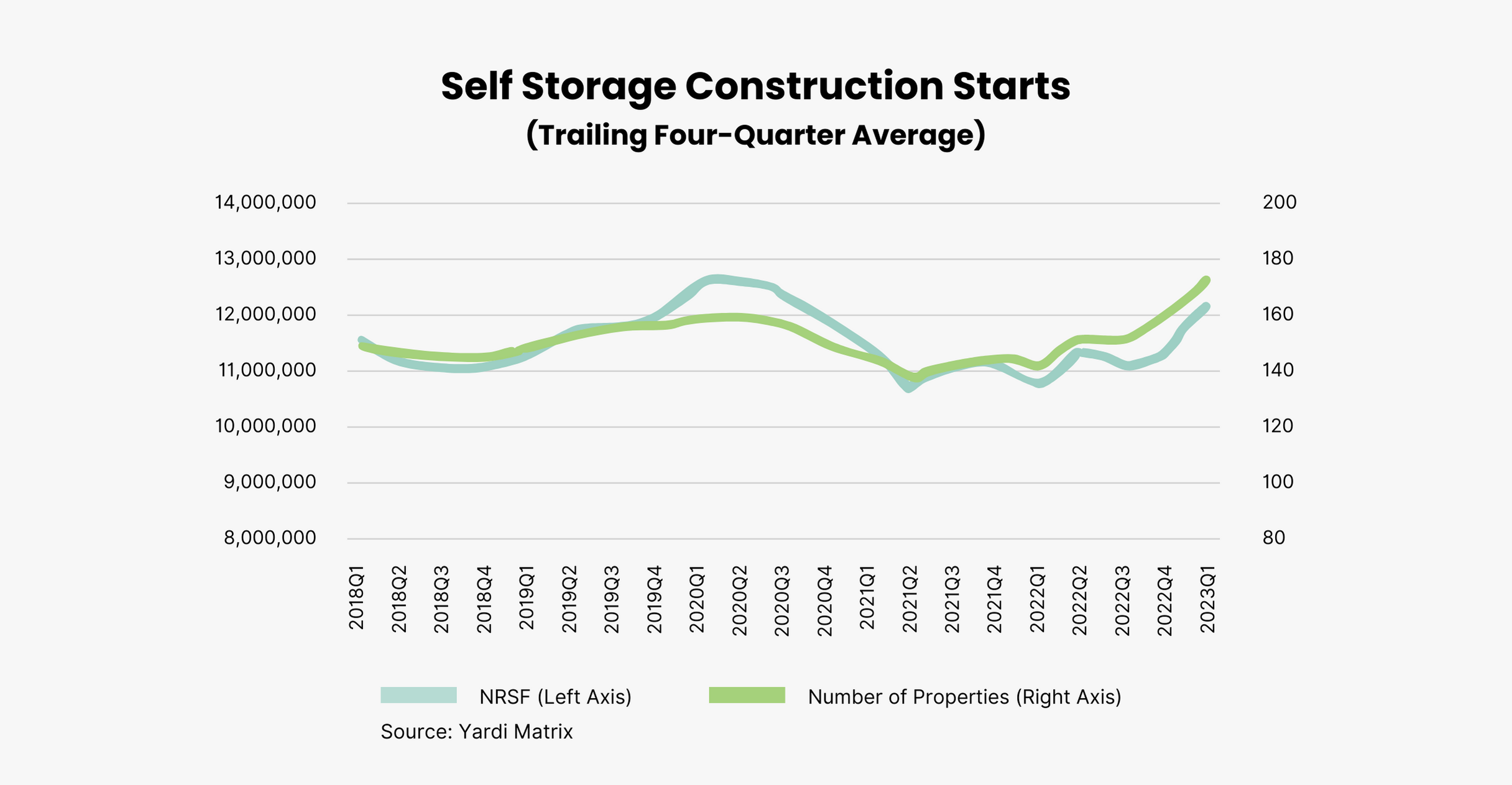

To complicate matters further, the development of new facilities is still going strong and filling many markets with competition even as demand slows.

Some markets may escape the press, but as a whole, the industry is trending towards leaner days.

More and more investors have entered the industry in the last decade. Across the industry, we’re seeing a lot of consolidation happening.

Storage is still fairly friendly to independent operators, but it’s undeniable that large players are buying up more and more property.

Nothing illustrates this better than Public Storage and Extra Space battling over Life Storage.

If you missed the news, here are the details: After Public Storage offered billions of dollars to acquire Life Storage and was rejected, Extra Space Storage swooped in and snagged Life Storage for $12.7 billion. This brings their total number of locations to over 3,500.

Following the loss of Life Storage, Public Storage turned around and acquired Simply Self Storage for $2.2 billion.

Let’s put these events into perspective:

The issue of consolidation can be intimidating.

It means more REITs are moving into your market, potentially. Some people believe it can make the industry as a whole more unforgiving for independent operators.

James McLean over at Radius+ sees it as a positive.

James McLean

Head of Business Development, Radius+

Whether you see it as a looming threat or a promise of stability, it’s happening, and you should keep track. If Simply Self Storage is in your backyard, it would have been great to know a month ago that it means Public Storage will be moving in.

It’s no secret that migration and the housing market have an impact on self storage industry trends.

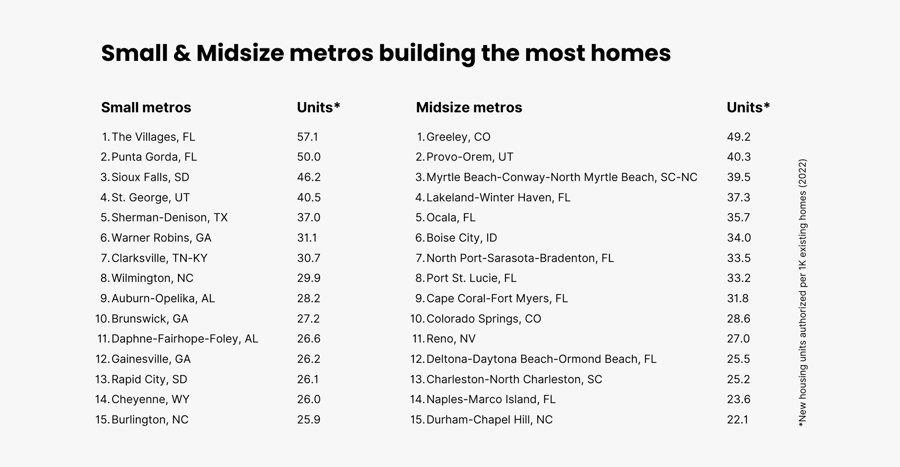

Keeping an eye on trends in residential development can help understand specific markets.

Here’s a list of states that are leading the country in new residential construction:

And for a snapshot of the fastest-growing small-to-midsized metro areas, take a look at this info from Construction Coverage:

What does that mean for self storage?

The booming residential construction in these areas could mean more migration to those regions, and that could help offset the cooling national averages in the coming months and years (if you operate in these regions).

More competition, lower rates, and fewer rentals make for a grim outlook when taken at face value.

Thankfully, as we've illustrated, numbers today are still above what we were seeing before the pandemic. And while there may be a percentage or two of difference in occupancy, as Raheem Amer of Mini Mall Storage points out, “historically, the industry has maintained a relatively stable occupancy rate.”

Even with pandemic highs being in the past, storage is still a resilient asset class in the long haul.

As for consolidation and increased REIT competition, our friends at USA Storage Centers believe “it is ultimately a vote of confidence that our industry is quickly evolving into a highly valued asset class.”

What this means is that the industry is still in a pretty good place, but individual facilities are probably starting to feel pressure. If you’ve planned your borrowing, hiring, or expenditures based on the highs of 2020 through 2022, you may need to start finding ways to trim back a bit until we see where the markets settle. Just don’t trim anything that gives you a competitive edge.

If you just want to stay on top of your competition, it’s time to start looking at any of those little things you overlooked the last few years, but that could help optimize parts of your business.

When competition becomes fierce, the finer details of running your facility (and your marketing) are what will carry you through to the top.

Thanks to Radius+ for the valuable data!

Want to stay on top of your storage game in the face of tough competition? Check out these resources!

At StoragePug, we build self storage websites that make it easy for new customers to find you and easy for them to rent from you.