Menu

August 16, 2022

Self storage auctions aren’t good business.

In the best-case scenario, you don’t lose money. If you manage the auction well and get some good bids, you’ll make around the same amount of money you would have made if the tenant just paid rent.

Sure, every now and again you’ll find an auction that makes you money, but typically if the contents of a unit are worth much, the tenant’s not going to let you sell the unit, right?

Sometimes auctions are your only option - but there are steps you can take to get ahead of the curve.

Auctions typically don't make the operator any money. Between the lost rent, the cost of holding the auction, and the time you as the operator spend dealing with auctions, you’re making less than you would if your tenant paid their rent and dues.

We’ll go over a few ways you can try to lower the number of liens and auctions your facility faces, freeing up time and improving your income.

The best advice we’ve found for handling collections, liens, and auctions is to “Be transparent about all expectations.” Your tenants should understand exactly what they’ll have to do, how much they’ll have to pay, when the payment is due, what the late fees are, and what the lien process looks like.

Check out our Gabfocus Spotlight on lien laws here!

This won’t stop all your auctions. Tenants will still lose their jobs, have their car break down, or otherwise be simply unable to pay for the self storage unit any longer. But you can’t control that, and you can control delinquency related to misunderstandings.

Additionally, if your tenants understand the processes, they’re less likely to feel cheated when you end up selling their stuff at auction.

Odds are good that you’ve agreed to some terms and conditions without reading them; your tenants are the same. They may not know that you’re legally able to sell their possessions to cancel their debt to you. They may not know how long they’ll have to pay their late fees before their unit goes to auction.

Do your best to make these things clear to all your tenants.

You can do this with welcome packages, bullet-point lists, and other forms of communication.

Self storage requires a lot of bookkeeping. Not only do you need to record who owes you payments, who has already paid, and who is falling behind, you have to keep track of constantly changing contact information.

Keeping track of a tenant’s correct address can be difficult if you cater to tenants in delicate financial situations. If a tenant has been displaced (one of the 3 Ds that send a lot of people into self storage), they may be moving around between different friends and family. They may be unable to keep up a regular phone number. They may have secondary contacts that change.

All these changes make it very hard for you to deliver late notices and lien notices, especially if you don’t have a good way to keep track of them. Quality property management software will make keeping track easier and more accurate

While you can’t get a new telephone number that the tenant doesn’t give you, if you have a system that integrates with all your locations and is easily accessible by all your employees, you lower the chances that you let an address change slip through the cracks.

Cloud-based software will update every location with the new contact information whenever someone updates it. Online accounts enable the tenant to update the information themself, which can be convenient too.

If you know how to contact your tenants, even ones who are moving around a lot or in bad situations, you’re much more likely to be able to get the problem solved without needing an auction.

Most tenants don’t want to be late on their payments - late fees are painful!

With all the subscriptions and bills your customers face, it’s easy for yours to slip through the cracks - especially if you don’t send reminders. While the best solution is to get tenants on autopay, that won’t work for every tenant.

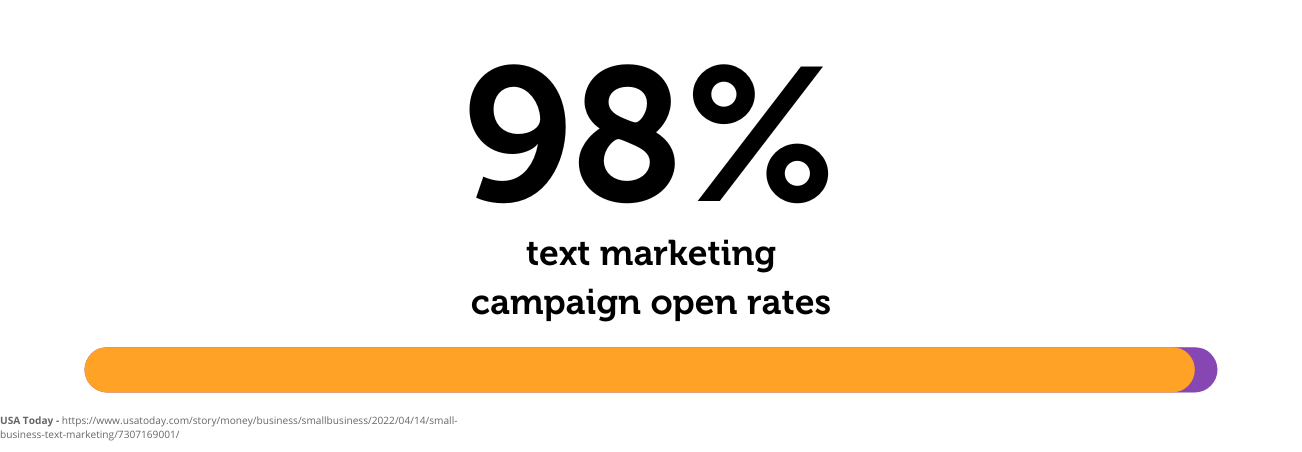

Instead, your PMS should be able to send payment reminders to tenants if they’re in danger of falling behind. Consider sending text messages, as they have a much higher open rate than emails do.

As always, make the situation as clear as you can. Explain in your email (or text) what the tenant owes and when it’s due. Then, lay out what will happen if the tenant doesn’t make the due date - what fees will be charged.

If the tenant continues to fall behind, send another update that explains the lien process. Make it very clear what will happen to the tenant’s unit and the stuff inside it.

These steps won’t make a tenant suddenly able to pay, but they can reduce your total number of delinquent tenants.

If you’ve got your whole payment system automated, you should also be able to see which tenants are behind, and which have been behind before.

Of course, for a small facility, you may be able to keep track of your delinquent tenants in your head, which is great. But once you expand and start taking on lots of renters, it’s useful to have a program where you can see who makes their payments late regularly.

See what our experts recommend for dealing with habitually late tenants here!

Once you’ve got an idea of who is paying late and who’s not paying at all, you can start to do something about it. Some operators don’t mind late payments because they make more money on the late fees, but others prefer to avoid the hassle.

If you’re in the latter group, consider insisting your late tenants go on autopay.

Weigh the extra money in late fees against the time you (or an employee) spends trying to chase down the tenant, then factor in the odds that eventually all that time will be wasted and you’ll have to send the tenant into lien anyways.

Good recordkeeping can be hugely beneficial here. Try to keep good notes in your PMS about the number of calls you make, how long you talk to the tenant, and how often you run into problems with this particular tenant.

Lastly, before you start evicting people for being habitually late, consider your occupancy rates. If you’re struggling to find tenants, you may need to be a bit more lenient with those who often run late. If people are knocking down your gate to get a unit, you can be picky about whom you let rent.

Autopay makes all of this easier because it shifts the burden of collections off of your shoulders. If you have a credit card on file for every tenant, your system will run the online payment process, collect your rent, and you can set about all the other million tasks you have to complete.

Debit cards may come back with insufficient funds sometimes, of course. Even then, you’ve saved yourself time by not needing to send reminders or run to the bank to cash checks.

Your tenants may be reluctant to swap to autopay, and the effort of getting them to switch may not be worthwhile. You don’t want to irritate your tenants, and if they’re still hesitant to pay for things online, you probably won’t convince them now.

On the other hand, if you can convince them (try offering a discount!), you’ll free up a lot of time and mental energy to spend on other parts of your business.

Learn more ways to improve your self storage facility with these:

At StoragePug, we build self storage websites that make it easy for new customers to find you and easy for them to rent from you.