Menu

June 27, 2023

Are you looking to add a new facility to your portfolio?

There are important considerations to make when you’re deciding whether or not a specific deal is worth investing in.

From market conditions to industry projections to the state of the physical facility, the factors to examine are plentiful.

Let’s take a look at some of the key pieces of information you should gather and what to do with it.

There’s no secret answer that will make sure you always find a winning deal. But there are ways to can increase your odds—and ways that you can protect yourself from many bad investments.

Analyzing a storage deal can seem very complex due to the number of storage units involved, all of the different ways you can manage a facility, and the numbers that need to be crunched to determine if it’s worthwhile.

Even worse, some of the numbers you need will only come from personal experience or good connections. For example, it’s not always easy to know how much to project for monthly repairs or insurance costs without having had experience running a facility.

This is where your advantage comes in if you’re a self storage veteran looking to expand your portfolio.

What does analyzing a deal even really mean? What’s the point?

The end goal of analyzing a deal isn’t just to determine the market value of a facility. It’s really about figuring out if a deal is worth it for you personally. There are 4 practical purposes for analyzing a storage deal:

It might be that extensive upgrades (such as smart units or boat & RV storage) could lead to an eventual profit or that adding more units on an empty part of the land will lead to an acceptable net operating income (NOI). It’s also possible that you’re not willing to put in that kind of effort for the next facility you want to buy or that you want to start earning your money back quicker than those scenarios allow.

To know how much a facility is actually worth and whether or not it’s the right fit for your goals, there is a long list of numbers and other information you need to gather:

Some of these items can and should be provided by a seller. If you’re using a listing service to find deals, it may be included in the listing. Contacting an owner directly may mean you need to remember to seek this information out.

Other details you may need to figure out on your own. Economic occupancy, for example, is something you very likely need to piece together based on information from both the current owner (or their broker) and your own market research.

Operational expenses are an integral part of your analysis.

If you do all the math on your loan costs, economic occupancy, and all of these other factors, but you forget the monthly and yearly costs of running the facility? You may as well have skipped doing the rest of the calculations altogether.

If you’re already in talks with an owner or the broker representing them, you can use a combination of their information and your own experience to make a projection for these expenses.

Ask the current owner how much they pay for utilities, how much they pay the manager, monthly repair costs, and so on. Some of this may change, of course—maybe you plan to increase the maintenance budget, or maybe you’ll pay your manager better.

But having a solid foundation to start from will help your analysis.

Pug Pro Tip: It's a good idea to have some additional capital in reserve, especially when first acquiring the facility. Once you have your monthly operational costs down, consider factoring two to three months of expenses into your loan.

Ideally, this information will be freely available as part of the deal.

If you’re only eyeballing a self storage deal from afar before deciding if it’s even worth your time to start talks, then you may be able to do a bit of research to find what you need.

Find the county the facility is located in. From there, you may be able to search the county’s public records for tax documents related to the facility and see what they’ve paid in the past.

Just keep in mind that a sale for a price over the assessed value of the property could result in the property taxes being higher in the future.

Economic occupancy will help you determine how much you can grow the facility’s NOI.

Physical occupancy is easy to understand. What % of the storage units are rented on average throughout the year versus what % are vacant?

Economic occupancy is a little bit more complicated, but it’s arguably more important for most facilities.

You can use this formula to find the economic occupancy:

That may be a little bit complicated at a glance. Let’s break it down with a quick example:

In this example, the facility’s physical occupancy may be 90%, but the economic occupancy is only 72%. This could be great news for you as a buyer if you believe you can increase the economic occupancy with minimal cost.

Closing costs can vary depending on how you’re buying the facility and where it’s located.

The trickiest part to be aware of—especially if you’re purchasing a facility in a state where you don’t have experience purchasing real estate—is who is responsible for paying the transfer tax.

Some states don’t have any transfer tax at all. States that do have transfer taxes may make the buyer responsible or the seller responsible for paying the tax.

Here are some other possible closing costs to be aware of:

While it’s good to know how a facility is doing right now, for this next step, you need to determine how well you think you can make it perform.

This number will help you calculate your NOI before your mortgage.

To figure out the property’s potential revenue, you need to figure out how much each storage unit is worth. This is why the unit mix is so important. Once you have the details of how many of each type of unit the facility holds, you can figure out the average market rate for those units, add it all up, and see how much you could make at 100% economic occupancy.

Here’s an example:

Once you have your 100% economic occupancy value, consider what you think a realistic physical occupancy is. In the past few years, it wouldn’t be hard to reach 95% or higher physical occupancy. A historical expectation would be a little lower, around the 85 to 90% range.

If you want to play it safe, shoot for something on the lower end. If market analysis makes you confident, maybe you can plan for the higher end.

Once you’ve settled on an expected average physical occupancy, you calculate your economic occupancy at that percentage.

Taking our example from above:

This is your projected monthly revenue.

Because we all know revenue isn’t profit, determining how much we’re willing to pay is going to be based on our projected revenue, minus our expected expenses, minus our mortgage payments.

Calculating your expenses is done via a combination of talking with the existing owner and pulling numbers from your own experience.

Some figures should be given to you by the broker handling the deal if you’ve reached that stage of the process:

You may even be able to rely on their staffing costs if you plan to keep the manager and not change their wages.

Some numbers will come from your own research and experience. Here are a few to consider:

Subtract these expenses from your projected revenue to determine your expected NOI.

Most likely, you’re going to get a loan from a bank or a private lender.

A loan means you’ll have a mortgage to pay, and the monthly costs will be largely based on your interest rate, the size of the loan, and other terms.

If your monthly expenses add up to $10,000, and your mortgage is another $10,000 monthly, but you only make $17,000 in rent each month? You’re bleeding money!

Because of this, how much you’re willing to offer should be a function of how much you’re willing to pay monthly for the loan.

If you can only afford to pay $5,000 a month on the loan, then you take that number and work backwards. Work with your lender to determine how much you can offer with what terms to reach your goal.

Once you know how much you can borrow and at what terms in order to stay below the max you’re willing to pay for the mortgage, you now know how much you can offer.

All of the numbers on the ledger might come up looking like roses, but that doesn’t mean something doesn’t stink.

On the other hand, there could be potential that isn’t represented by the data you’re seeing.

Here are some other things to keep in mind when you’re viewing a deal and wondering if you should bite.

This is probably the most obvious additional step to take. You need to look at the property.

Ideally, this means putting eyes on it directly, but it could also mean up-to-date photos and video if your situation demands it.

Here are some things to look at:

Some of these items will lead to additional costs, and some might be an opportunity for additional revenue (or an easy way to turn around a mismanaged property).

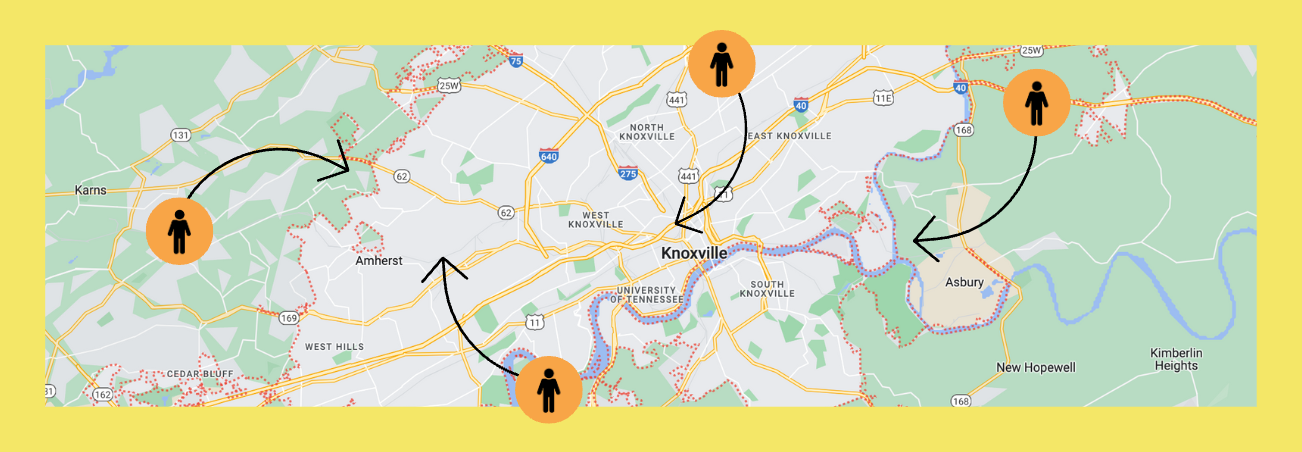

Whether you intend to keep the facility for the foreseeable future or have aims to sell it in five to ten years, you shouldn’t just be looking at the state of the market today. Instead, you should look at what the market might look like down the road.

If the property’s local market is showing signs that people are migrating out in larger numbers than they’re coming in, it may signal that this deal is riskier than it looks on paper.

If you’re unlucky in the worst-case scenario, this could be its last good year.

The opposite might also be true. Is it in a tertiary market where a large company is opening a new plant? Are there many planned housing developments? Has there been a pattern of increased migration to the area for other unexplained reasons?

This may all signal that the property is more attractive than current figures suggest.

Most of the time, the online reviews shouldn’t be too important when analyzing a deal. But there’s a chance that they are exceptionally poor, and this is when they might present a problem for you.

If you plan to rebrand, this might not be as big of a problem. Even a rebrand can still suffer some of the community’s lingering thoughts on a business, though, depending on the density of the market.

If you’re not changing the storage facility’s branding when you acquire it, then a very bad history of reviews on Google can present a real challenge in terms of regaining the faith of customers that shop online.

You can check out our guide on rebranding a facility to help determine what steps you might need to take.

Looking at a smaller market with less competition, you may feel comfortable with a smaller projected marketing budget.

But surprise: The few competitors you do have all run aggressive Google Ads campaigns, work with local organizations, and have billboards up and down the street!

At some point, your marketing efforts—and your marketing budget—need to match your competitors if you plan to keep up.

See what they’re doing because it could end up forcing you to shift your expected marketing budget!

Want to see more interesting self storage information and guides? Check out some of these posts:

At StoragePug, we build self storage websites that make it easy for new customers to find you and easy for them to rent from you.